IANA: ‘Intermodal Makes Gains’

Written by Marybeth Luczak, Executive Editor

(Courtesy of IANA)

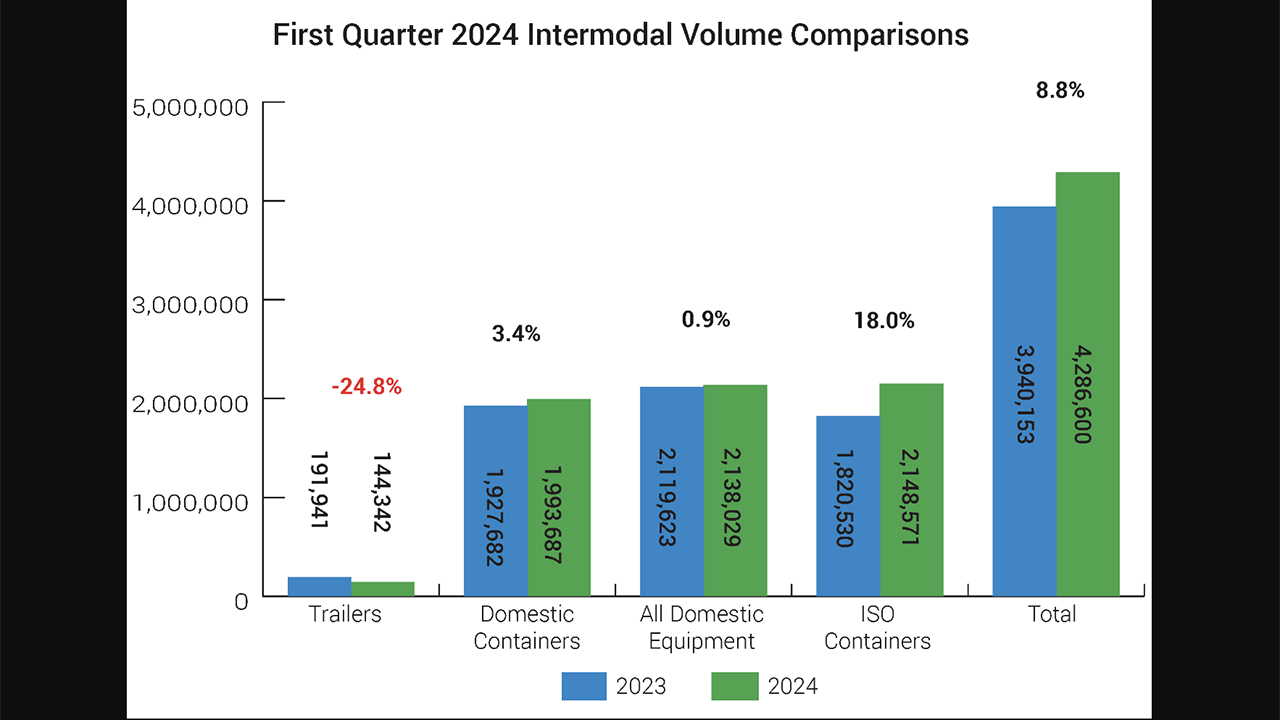

Total Intermodal volume for first-quarter 2024 was up 8% from the prior-year period, according to IANA’s (Intermodal Association of North America) latest report. It was the second consecutive quarter of year-over-year growth.

“International volume growth was the driver for continuing intermodal industry gains in the first quarter,” IANA President and CEO Joni Casey said during the report’s release April 30. “Consumer spending provided a basis for definitive import increases.”

The Intermodal Quarterly report noted that “[d]espite high interest rates, moderating but lingering inflation, and fears of a pullback in consumer spending and industrial activity, the U.S. economy continued to show surprising resilience in the first quarter.” It pointed out that “industrial activity picked up, and the March ISM Manufacturing Index clawed back into expansion territory for the first time since September 2022. Likewise, consumer spending continued to work down bloated retail inventories, driving imports in the face of trade disruptions in the Red Sea and at the Panama Canal.”

For the three-months ending March 31, 2024, international containers added 18.0% and domestic containers improved 3.4% over the same period in 2023, while trailers fell 24.8%, according to the IANA report (download below).

All but one of the seven highest-density trade corridors, which collectively handled more than 60% of total volume, were up. The South Central-Southwest climbed 25.9%; Southeast-Southwest,19.1%; Midwest-Southwest,15.4%; Northeast-Midwest,10.8%; Intra-Southeast, 10.2%; and Trans-Canada, 2.7%. The Midwest-Northwest dropped 3.1%.

Total IMC (intermodal marketing company) volume dipped 0.4% year-over-year, with intermodal traffic down 3.6% and highway loads up 1.6%.

“With containerized imports on the rise, especially on the U.S. West Coast, the outlook for international containers moving by rail is forecast to move up 9.0% for full-year 2024, notwithstanding the tougher quarterly comparisons that lie ahead,” according to the IANA report. “Loose trucking conditions are expected to keep a lid on domestic containers, limiting full-year growth to 2.5%. Furthermore, the slide in trailer loadings will likely continue, leading to a 20.3% loss. All combined, total North American intermodal volume is anticipated to increase 4.6% in 2024. Higher interest rates, which typically take time to be fully felt throughout the economy, remain a variable, and progress on the inflation front has slowed a bit, forcing the Fed to rethink their rate cutting strategy. Higher interest rates for longer would likely result in a downward revision to some economic outlooks as borrowing costs remain higher for businesses and consumers.”